Chime is one of the fastest-growing fintech companies in the United States, offering banking services and financial tools to help Americans improve their financial health.

In just a few short years, Chime has amassed 14.5 million customers by focusing on eliminating fees, providing access to paychecks early, and automation tools to help users save money effortlessly.

The growth of Chime has also been fueled by word of mouth, with existing customers enthusiastically sharing their positive experiences.

This has allowed the company to expand rapidly without a large marketing budget. According to Chime’s CEO, the company grows by 20,000 new accounts per day.

Behind the scenes, Chime relies heavily on data, analytics, and statistics to improve its products and target new services to match consumer needs.

For example, by analyzing customer data Chime realized that many users were prone to overdrafting their accounts between paychecks.

In response, the company launched SpotMe, which uses algorithms to determine a user’s risk profile and provide fee-free overdraft coverage when needed.

Statistical modeling helps Chime determine which users would benefit most from savings reminders, balance alerts, or other prompts. As a result, customers have saved over $10 billion using Chime’s automated tools.

Company Overview

- Launch date: Chime was Founded on 15th April 2014

- HQ: The company is located in San Francisco (California)

- Founder: Chris Britt (CEO), Ryan King (CTO)

- Business Type: Fintech Company

- Industry: Online banking

Chime Key Stats:

- Chime 2023 Revenue is estimated to be $3.16 billion.

- Chime’s Valuation in 2021 was $25 billion.

- Chime has an estimated 21.6 million users in 2023.

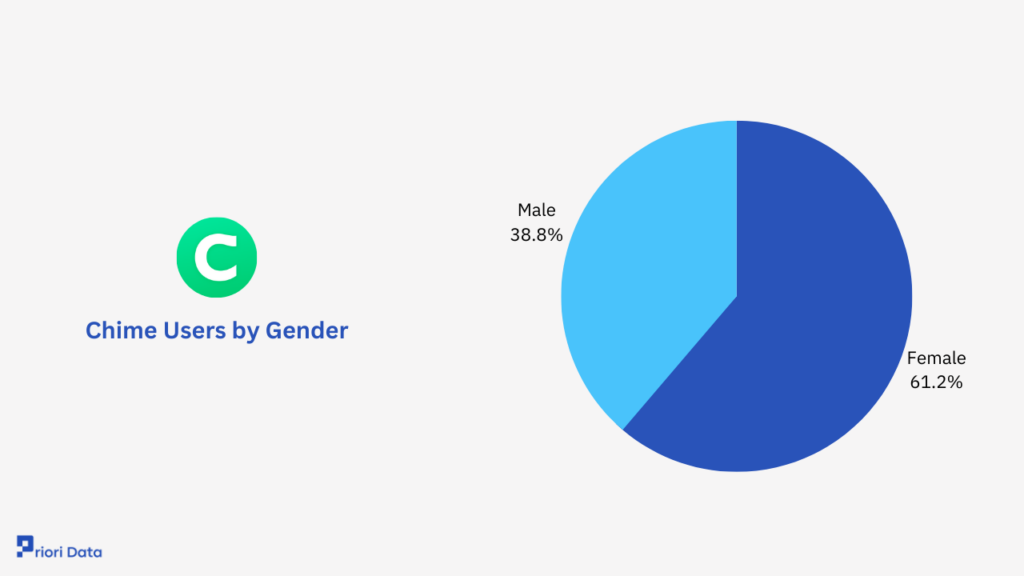

- Chime’s user base is 61.24% female and 38.76% male.

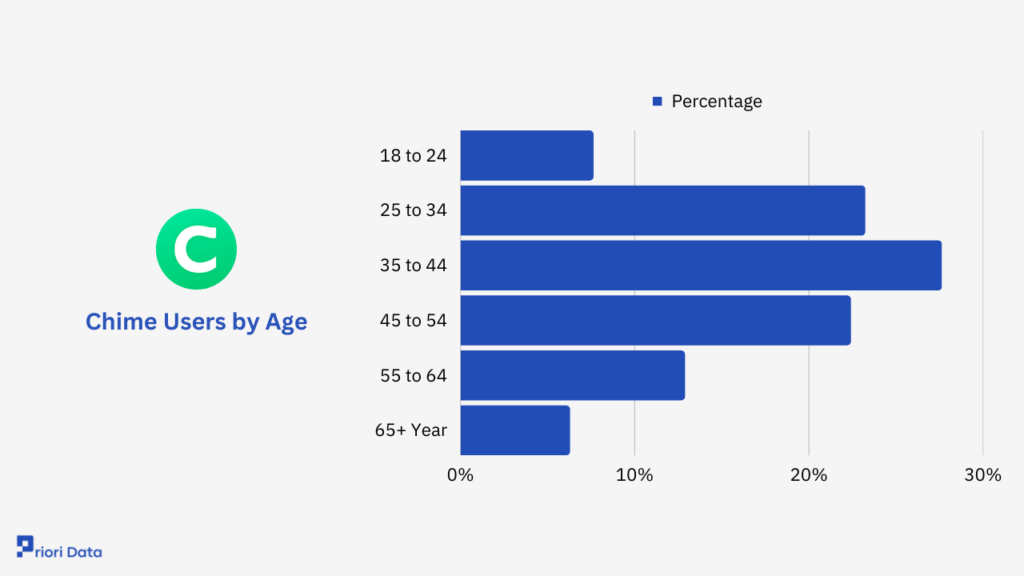

- The largest user age group for Chime is 35-44 years at 27.62%.

- Chime is the top choice among Neobank users with 48% preference.

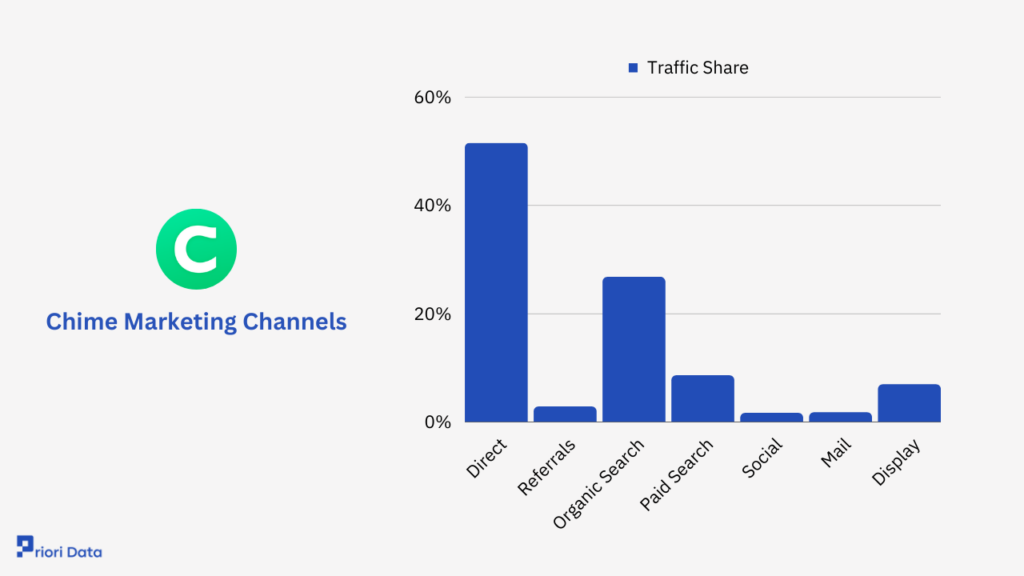

- Chime’s main marketing channels include 51.50% direct traffic and 26.74% organic search.

- Chime has around 14.5 million customers, out of which 9 million use Chime as the primary account

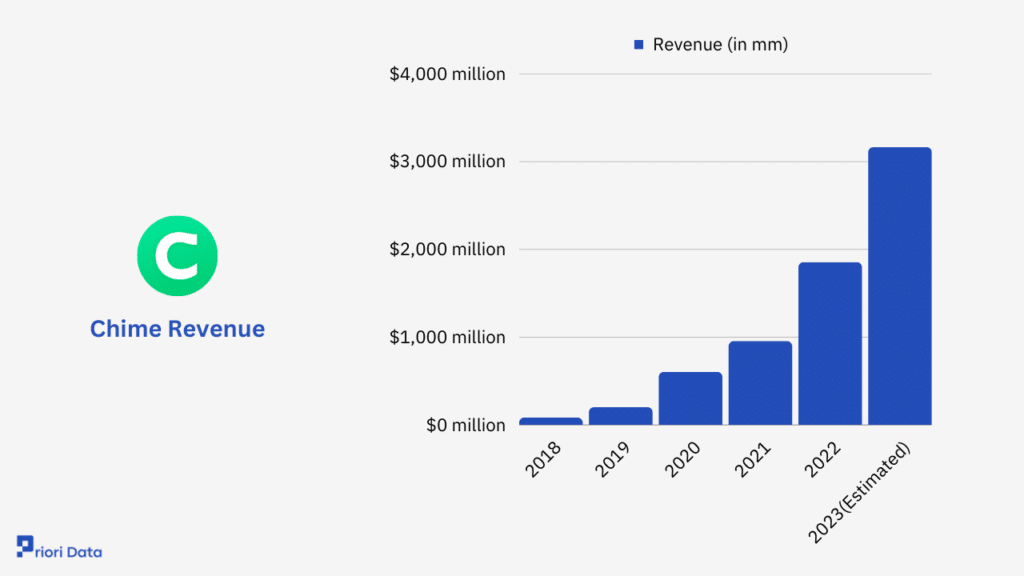

Chime Revenue

Over the past five years, Chime has exhibited remarkable revenue growth, positioning itself as a prominent player in the financial services industry.

In 2018, Chime’s revenue stood at $80 million, which then surged to $200 million in 2019, marking a significant increase.

However, it was in 2020 that Chime experienced an exponential leap, reaching a revenue of $600 million, showcasing the platform’s growing popularity.

This momentum continued into 2022 when Chime’s revenue skyrocketed to $1.85 billion.

As we anticipate the future, Chime’s estimated revenue for 2023 stands at an impressive $3.16 billion, demonstrating the platform’s continued expansion and dominance in the financial sector.

Chime revenue: 2018 to 2023

| Year | Revenue (in mm) |

|---|---|

| 2018 | $80 million |

| 2019 | $200 million |

| 2020 | $600 million |

| 2021 | $950 million |

| 2022 | $1850 million |

| 2023(Estimated) | $3160 million |

Sources: Forbes, The Information

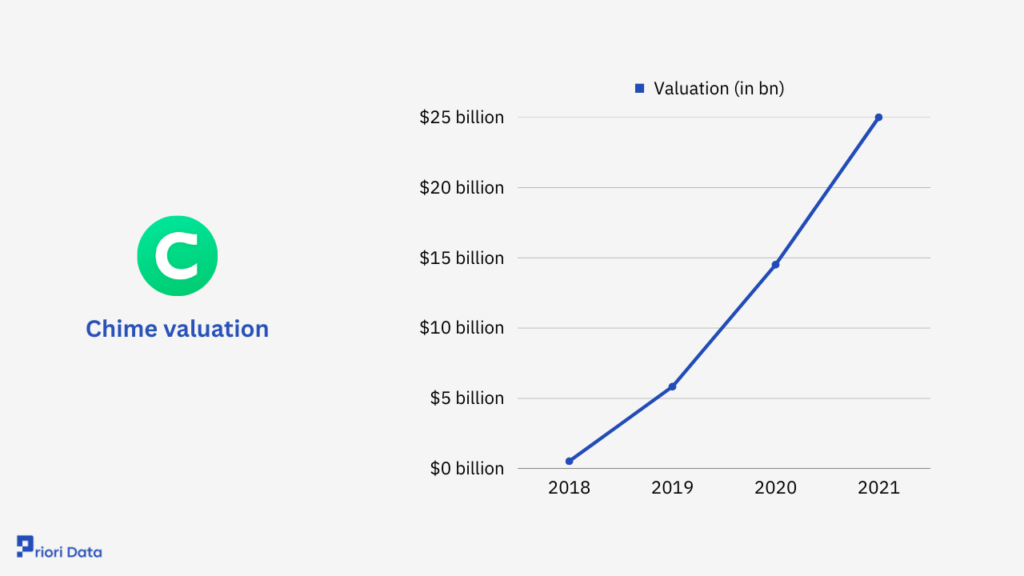

Chime valuation

Over the years, Chime’s valuation has experienced significant growth.

In 2018, it was valued at $0.52 billion, followed by a substantial increase to $5.83 billion in 2019.

The trend continued with a valuation of $14.51 billion in 2020, and it reached an impressive $25 billion in 2021.

| Year | Valuation (in bn) |

|---|---|

| 2018 | $0.52 billion |

| 2019 | $5.83 billion |

| 2020 | $14.51 billion |

| 2021 | $25 billion |

Sources: TechCrunch

Chime Funding

| Date | Round Name | Investors | Funds Raised | Lead Investors |

|---|---|---|---|---|

| Jul 28, 2023 | Series B – Chime | 1 | — | — |

| Aug 13, 2021 | Series G – Chime | 6 | $750M | Sequoia Capital Global Equities |

| Sep 18, 2020 | Series F – Chime | 10 | $533.8M | — |

| Jan 21, 2020 | Secondary Market – Chime | 1 | — | — |

| Dec 5, 2019 | Series E – Chime | 8 | $700M | DST Global |

| Mar 5, 2019 | Series D – Chime | 9 | $200M | DST Global |

| May 31, 2018 | Series C – Chime | 9 | $70M | Menlo Ventures |

| Sep 27, 2017 | Series B – Chime | 9 | $18M | Cathay Innovation |

| May 19, 2016 | Series A – Chime | 6 | $9M | Aspect Ventures |

| Nov 5, 2014 | Series A – Chime | 4 | $8M | Crosslink Capital |

Sources: Crunchbase

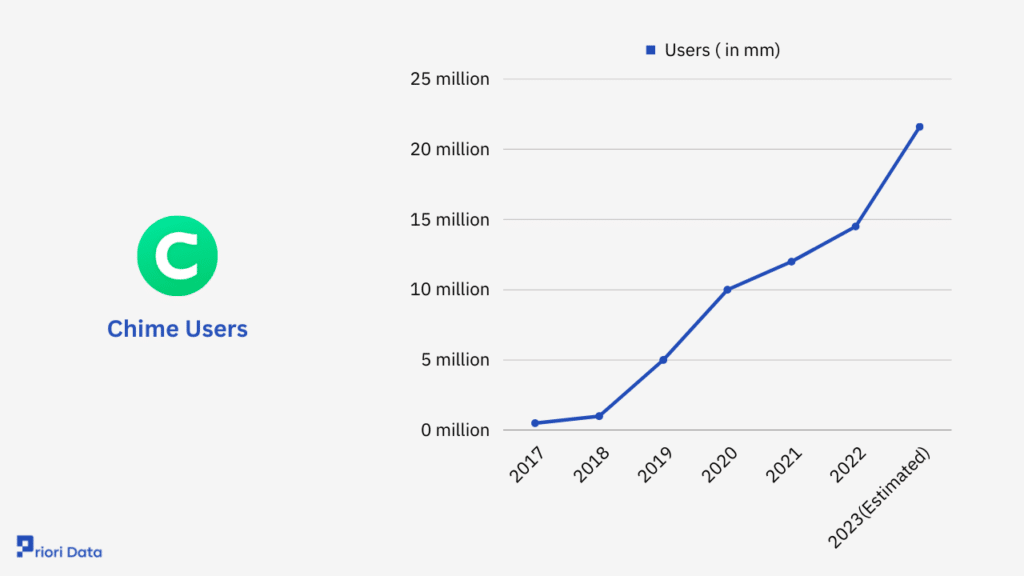

Chime users

Examining the data on Chime’s user growth over the years, it’s evident that the digital banking platform has experienced remarkable expansion.

In 2017, Chime began with half a million users, and by 2018, that number had doubled to 1 million.

The subsequent year, 2019, marked a significant turning point as Chime’s user base skyrocketed to 5 million.

This impressive momentum continued into 2022, with 12 million users. Looking ahead to 2022, the growth continued steadily, reaching 14.5 million users.

Projections done by Tickernerd for 2023 are even more remarkable, with an estimated 21.6 million users, making Chime a preferred choice for millions seeking convenient financial services.

Chime users: 2017 to 2023

| Year | Users ( in mm) |

|---|---|

| 2017 | 0.5 million |

| 2018 | 1 million |

| 2019 | 5 million |

| 2020 | 10 million |

| 2021 | 12 million |

| 2022 | 14.5 million |

| 2023(Estimated) | 21.6 million |

Sources: Statista

Chime Users by Gender

Approximately 61% of Chime users are female, while 38% are male.

| Gender | Percentage |

|---|---|

| Female | 61.24% |

| Male | 38.76% |

Chime Users by Age

After analyzing the Chime user demographics by age, it’s evident that Chime attracts a diverse user base.

The largest age group among Chime users falls within the 35 to 44 range, comprising 27.62% of the total user population.

Following closely behind are users aged 25 to 34, making up 23.22%.

The younger demographic of 18 to 24-year-olds constitutes 7.62% of Chime’s user base, indicating some appeal among this group.

These statistics highlight Chime’s broad appeal across different age brackets, making it an inclusive and popular choice among a wide range of users.

| Age Group | Percentage |

|---|---|

| 18 to 24 | 7.62% |

| 25 to 34 | 23.22% |

| 35 to 44 | 27.62% |

| 45 to 54 | 22.39% |

| 55 to 64 | 12.87% |

| 65+ Year | 6.27% |

Chime Vs other Neobanks

An online survey was conducted in the United States among 1,241 respondents aged 18 to 64 years and below are the findings:

Among the Neobank options, Chime emerged as the clear winner, with an impressive 48% of respondents choosing it as their preferred Bank.

Current followed closely behind, with 33% of respondents opting for it.

Dave, Acorns, and Aspirations also demonstrated significant appeal, with 32%, 31%, and 29% of respondents.

Go bank rounded out the list, with a respectable 28% of respondents indicating their preference for it.

| Neobanks | Percentage |

|---|---|

| Chime | 48% |

| Current | 33% |

| Dave | 32% |

| Acorns | 31% |

| Aspirations | 29% |

| Gobank | 28% |

Source: Statista

Neobank Account Holders

In the world of neobanking, Chime is the leader with a whopping 13.12 million account holders, showing its strong presence.

Current and Aspiration follow with 4 million and 3 million account holders respectively, while Varo has 2.7 million users.

There are also 2.5 million account holders among other neobanks, highlighting the presence of smaller players.

| Neobanks | Account Holders (in mm) |

|---|---|

| Aspiration | 3 million |

| Chime | 13.12 million |

| Current | 4.0 million |

| Varo | 2.7 million |

| Other Neobanks | 2.5 million |

Source: InsiderIntelligence

Chime Marketing Channels

When it comes to marketing channels, the majority of traffic, at 51.50%, comes directly to the website.

Organic search accounts for 26.74% of the traffic, showing that people are finding the site through search engines.

Referrals bring in 2.84% of visitors, while social media and mail each contribute around 1.64% and 1.77% respectively.

| Marketing Channels | Traffic Share |

|---|---|

| Direct | 51.50% |

| Referrals | 2.84% |

| Organic Search | 26.74% |

| Paid Search | 8.60% |

| Social | 1.64% |

| 1.77% | |

| Display | 6.91% |

Source: SimilarWeb

Frequently Asked Questions (FAQ)

Q1. Is Chime a bank?

Ans: No, Chime is a Fintech company that has partnered up with Bancorp and Stride Banks to provide banking services.

Q2. Who owns Chime?

Ans: Chime is owned by Chris Britt (CEO) & Ryan King (CTO)

Q3. Where is Chime Bank located?

Ans: Chime is located in San Francisco

Q4. How does Chime make money?

Ans: Chime has two main revenue streams. Every time a customer uses a Chime card, it takes a 2% fee from the merchant. Chime also makes about 21% of its revenue by charging customers a fee for using out-of-network ATMs.

Q5. What is the Chime Interest rate on a savings account?

Ans: Chime gives an annual interest rate of 2% on the savings accounts. The interest is paid monthly to the customers.

Q6. What banks does Chime use?

Ans: Chime has partnered up with Bancorp and Stride Bank to provide excellent banking services to their customers.

Q7. Is Chime FDIC insured?

Ans: No, Chime is not FDIC insured as it is a technology company and not a Bank. However, the partner banks Bancorp and Stride are FDIC-insured. Therefore, your more is safe with chime.

Q8. Is Chime a Checking Account?

Ans: Yes, Chime provides both checking and savings accounts.